Total Addressable Market, or TAM for short, can take the fear out of launching a new product or service. Instead of worrying about questions like, ‘What if the market isn't receptive?’ or ‘What if our offering falls flat?’, you can focus on how to market to your ideal customer instead.

In our complete guide, we'll give you the lowdown on the metric that reveals the revenue potential of new offerings within specific markets.

Read on to discover what TAM is, why it's crucial for your go-to-market (GTM) strategies, and most importantly, how you can crunch those numbers to make sure your new venture hits the ground running. Let’s get started.

What is the meaning of TAM?

The TAM abbreviation stands for Total Addressable Market (sometimes called Total Available Market). It refers to the total market demand of a product or service if you achieve a 100% market share.

What is Total Addressable Market exactly?

Now that you have a decent understanding of what TAM means, let’s get into the specifics.

Total Addressable Market (TAM) is an evaluation of the maximum potential revenue opportunity for your specific product or solution. So, it represents the potential size of the market if every customer were to adopt the offering, achieving 100% market share.

Now, we think it's important to point out that TAM doesn't actually represent the specific figure associated with your future customers or revenue. Instead, it serves as a theoretical framework that tells you (and your potential investors) the total size of the market before those pesky external factors, like competition and alternative solutions, come into play.

For example, if you work as a marketing manager for a web analytics company that’s just introduced a new data visualization tool, your TAM would include every business, large or small, that could potentially benefit from better data presentation. We’re talking about industries like finance, healthcare, e-commerce, and more.

Why is Total Addressable Market important?

Regardless of whether you plan to launch a new company and work out its industry’s profit potential or predict a realistic revenue growth goal for a business you’ve already launched and built up, measuring your TAM is an important step you’re going to have to take. Here’s why:

Validates your business idea: You might have a business idea that you think is a winner, but TAM can help reveal whether it holds as much promise as you initially believed and give you that much-needed reality check by providing data on the market's size and potential customer base. For example, if you want to launch a content marketing agency, TAM analysis can help you see if there’s enough demand for one in your chosen location setup.

Expands thinking beyond current markets: TAM makes you think beyond where sales are currently happening. For instance, you might start considering ideas that could expand the overall market or create entirely new ones. Think about it: Does your product or service have the potential to shake up an existing market? Getting a handle on your TAM can work wonders for financial planning and forecasting, especially when you're looking to break into new, uncharted territories.

Accelerates your Go-to-Market (GTM) plans: When you calculate and use TAM effectively, it can significantly speed up your GTM strategy. It helps you figure out how to break down your market, distribute your product, sell it, and market it to potential customers, which in turn can lead to faster market entry and increased competitiveness.

Better Understanding of Ideal Customer Profiles (ICPs): Getting your TAM right also means gaining a better grasp of your Ideal Customer Profile (ICP). This brings several advantages, such as reducing conflicts between sales and marketing teams by ensuring alignment on promising leads. It also provides your marketing and sales teams with a clearer list of potential customers to target, enhancing their chances of success.

How can you use TAM data to make informed business decisions?

If you’re still thinking ‘What is TAM in business good for?’, the short answer is simply helping you make better decisions.

TAM data helps you plan your strategies better by showing you how big the market is and where the opportunities lie. You can also focus your efforts on the parts of the market with the most potential for making money, optimizing your B2B marketing, sales, and product development initiatives.

Plus, TAM data helps you spot risks early on, so you can adjust your plans if needed. It also gives you insights into how you stack up against the competition, helping you find your unique place in the market.

What is an example of Total Addressable Market?

We're now going to take you back in time to show you how TAM played an extremely important role in shaping the trajectories of one of the most iconic hospitality tech companies currently operating: Airbnb.

It’s 2009 and Airbnb is just getting off the ground. At this point, the idea of staying in someone else's home while traveling is unheard of, and the traditional hotel industry is dominating the hospitality sector.

Airbnb's founders saw an opportunity to disrupt the market by connecting travelers with unique accommodation options offered by individual hosts. However, before they could convince investors to buy into their vision, they needed to understand the TAM for their platform.

Using TAM analysis in their initial pitch deck to investors, the founders were able to provide a concrete idea of what they could achieve with their business. The result? The founders walked out of their pitch presentation with $600K in funding and went on to propel Airbnb to Unicorn status and beyond.

How to calculate TAM in four different ways

We’ve answered ‘What does TAM stand for?’ and ‘Why is TAM sizing useful for businesses?’ now, so, let’s get down to business and sink our teeth into how to calculate total addressable market (TAM). Here are the four primary methods:

1) Top-down approach

In the top-down approach, you’re going to be relying on industry data, market reports, and research studies to figure out your TAM.

This method is all about getting data from those reputable sources we all know and love, like Gartner or Forrester. You’ll use this data to spot any relevant sections of your industry and assess their size.

However, it's important to note that industry-generated data might not always be current or cover the niche aspects of the market you need. If you find that’s the case when you’re creating your TAM sizing, consider hiring a market research consulting firm to conduct tailored research. This can provide more accurate and specific insights.

2) Bottom-up approach

The bottom-up approach to TAM uses first-party data from your own sales and pricing information.

First, you multiply your average sales price by your current customer count. This will give you your annual contract value (ACV). You then multiply your ACV by the total number of potential customers in your total addressable market. That’s how you get your TAM.

Here’s a simple formula to help:

(Total # of customers) x (Average contract value) = Total Addressable Market (TAM).

To put this into perspective, let’s take a look at an example.

If you sell cupcakes to bakeries in California and typically sell 1,000 cupcakes a year at $5 each, your ACV would be $5,000. By multiplying your ACV ($5,000) by the total number of bakeries in California (which is around 31,000), your TAM would amount to $155,000,000).

3) Value theory approach

The value theory approach focuses on understanding how much value customers would get from your product or service and how much they’d be willing to pay for it in the future.

Let’s go back to our cupcake example. Imagine you have a special type of cupcake with a secret recipe and amazing taste. Using this approach, you’d figure out if customers would pay more for your premium cupcakes compared to standard ones. For instance, if regular cupcakes sell for $3 each, would customers be willing to pay $7 for your gourmet ones?

To answer this question accurately, you can’t just guess. You’ll need to conduct a competitive pricing analysis, looking at what your direct and indirect competitors offer and their prices.

Let’s say you do believe customers would pay $7 for your cupcakes, now you have to get into the maths. Assuming about 20% of all cupcake lovers in your area prefer premium cupcakes, and there are approximately 1,000,000 potential customers, that means there are 200,000 people interested in your cupcakes. So, you’d take your premium cupcake price ($7) and multiply it by the number of customers in that segment (200,000). Your final Total Addressable Market (TAM) is $1,400,000.

4) Another option: external tools

Finally, like all aspects of business nowadays, you can find a number of automation tools to help you completely streamline this process. This will save you time and effort that you can then use to work on your pitch deck to potential investors, flesh out your new product or service offerings, or create engaging marketing campaigns.

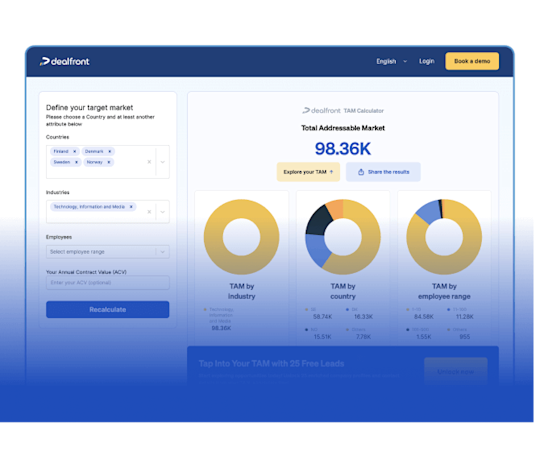

The best thing about this option is that you won’t even need to spend a penny. With tools like Dealfront’s TAM Calculator, you can complete your TAM calculations in minutes completely free of charge. Just enter the relevant information into the fields as required, then let the total addressable market calculator do the hard work for you!

What are the differences between TAM vs. SAM and SOM?

You might have heard these terms tossed around in business meetings or strategy sessions, but what do they really mean? While they all apply to market landscape and business strategy, they have distinct purposes. Here’s an overview to help you out:

Concept | Definition | Key insight |

TAM (Total Addressable Market) | Represents the entire demand for a specific product or service within a given market. | Provides a bird’s eye view of the market's scalability potential. |

SAM (Serviceable Addressable Market) | Shows you the portion of the TAM that a company can realistically target and serve. | Focuses on identifying target market segments aligned with the company's capabilities. |

SOM (Serviceable Obtainable Market) | The percentage of the market that a company currently captures or aims to capture. | Offers insights into the company's market penetration and sales potential in the near future. |

Are there any limitations or challenges associated with TAM analysis?

All good market sizing methods come with some downsides or considerations that you’ll need to be aware of. For Total Available Market these include:

Data availability: It’s not always going to be easy to obtain the accurate and up-to-date data you need. This is especially true for companies that have niche markets or work in emerging markets where data may be scarce.

Market dynamics: We live in a world that is constantly changing and developing. So, predicting future trends and accurately estimating TAM can be difficult.

Assumptions and uncertainties: TAM analysis often involves making assumptions about market size, customer behavior, and competitive landscapes, which introduces uncertainties into the Total Addressable Market calculations.

What factors should you consider when estimating TAM?

With the above challenges pointed out, calculating TAM requires careful consideration of several factors:

Market segmentation: Divide the market into distinct segments based on relevant criteria, such as demographics, psychographics, or behavior.

Addressable customer base: Determine the number of potential customers within each segment who would benefit from your product or service.

Market trends: Analyze current and projected market trends, including growth rates, technological advancements, and regulatory changes.

Competitive landscape: Assess competitors' market share, pricing strategies, product offerings, and customer base to understand your position in the market.

Customer needs and preferences: Identify customer pain points, preferences, and buying behavior to tailor your offerings effectively.

Industry analysis: Consider industry-specific factors, such as barriers to entry, substitute products, and supplier power, that may impact TAM calculations.

By carefully considering these factors, businesses can mitigate the challenges associated with TAM analysis and make sure they have a more accurate idea of their market potential.

Can TAM change over time, and if so, how?

TAM absolutely can change. Markets are always changing, making it hard to stay ahead. Customer preferences, needs, and behaviors can also shift unexpectedly, influenced by things like new tech, cultural trends, or economic changes.

Adapting to these changes means being flexible and ready to switch things up when needed. If you get good at predicting these shifts and adjusting your offerings quickly you’ll do best in this fast-paced world.

Unlock your TAM using our large-scale, fully compliant EU data of companies and contracts

So there you have it. Our complete guide on TAM analysis, packed with all of the information you need to start using this powerful method for your business growth and success.

We’ve covered it all; from what TAM means to why it’s so necessary. We’ve also explained the different ways to calculate TAM yourself. So, whether you’re wanting to launch a new product or service, expand into a brand new market, or just refine your existing strategies, TAM analysis can help.

Discover the true size of your TAM in seconds with the Dealfront TAM Calculator from the most accurate B2B database in Europe. With a database of over 40 million companies, you can get immediate, customized results and explore potential opportunities with free access to 25 enriched company profiles, including contact details, from your TAM.

Try it now and fuel your business growth!